If you run ads long enough, you’ll feel it.

Traffic looks fine. Clicks keep coming. Spend is steady.

But pipeline feels… weird. Sales says the leads are “not it.” Or worse, they go quiet after the first call.

In B2B SaaS, this happens a lot because people click for many reasons that have nothing to do with buying.

The good news is you can usually tell what kind of clicks you’re paying for within a week, sometimes within a day, if you know what to look at.

Jump to:

What does a “never close” click look like in B2B SaaS?

A “never close” click is not always a bot or a mistake.

It can be a real person who is:

- Curious but not qualified

- Researching for a project that is 6 to 12 months away

- Comparing tools with no budget authority

- Looking for a template, pricing screenshot, or feature list

In B2B SaaS, the click can be valid, but still not commercially useful right now.

So the question is not “Are these clicks real?”

The question is “Are these clicks connected to revenue intent?”

Are you optimizing for clicks when you actually need revenue signals?

This one hurts because it looks like progress.

If your campaigns are optimized to maximize clicks, landing page views, or even low-intent conversions, the platform will happily find more of that.

It is doing its job.

But if your sales cycle is longer and your deal size is meaningful, you need optimization signals that resemble buying behavior.

In B2B SaaS, that usually means actions like:

- Demo request with strong fit fields

- Pricing page visit plus time on page

- Product comparison page engagement

- “Book a call” with qualification questions

- Trial starts where the trial to pay is realistic for your model

A simple rule: if the conversion does not correlate with opportunities in the CRM, it should not be the main optimization event.

Do your ads attract the right intent, or just the right curiosity?

Many ads are written to win the click, not win the customer.

Curiosity copy gets engagement. It also pulls people who want answers, not outcomes.

If your ad is focused on features, broad pain points, or generic claims, you will attract browsers.

Try pressure testing your ad message with this question:

If someone clicks this, what are they hoping to get in the next 30 seconds?

If the answer is “learn more” or “see what this is,” expect low close rates.

If the answer is “I need this solved” or “I want to talk,” you’re closer.

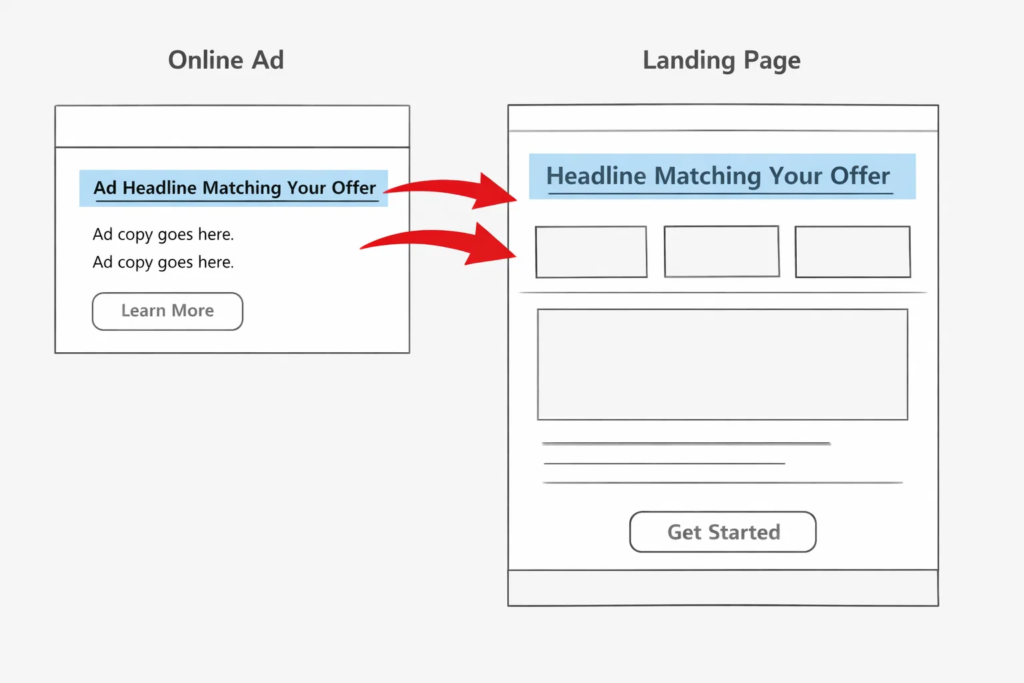

Is there a mismatch between the ad promise and the landing page?

Message match is a silent budget killer.

If your ad says “Automate sales reporting,” but the landing page opens with “All in one platform for teams,” people bounce.

Those bounces are not just lost clicks. They also train the algorithm to find more people who bounce, because the system is trying to predict who will click, not who will close.

Quick checks that catch this fast:

- Headline repeats the ad promise in plain language

- The first section answers “Who is this for?”

- The page shows proof within the first scroll

- The call to action matches the stage; not every visitor is ready for a demo

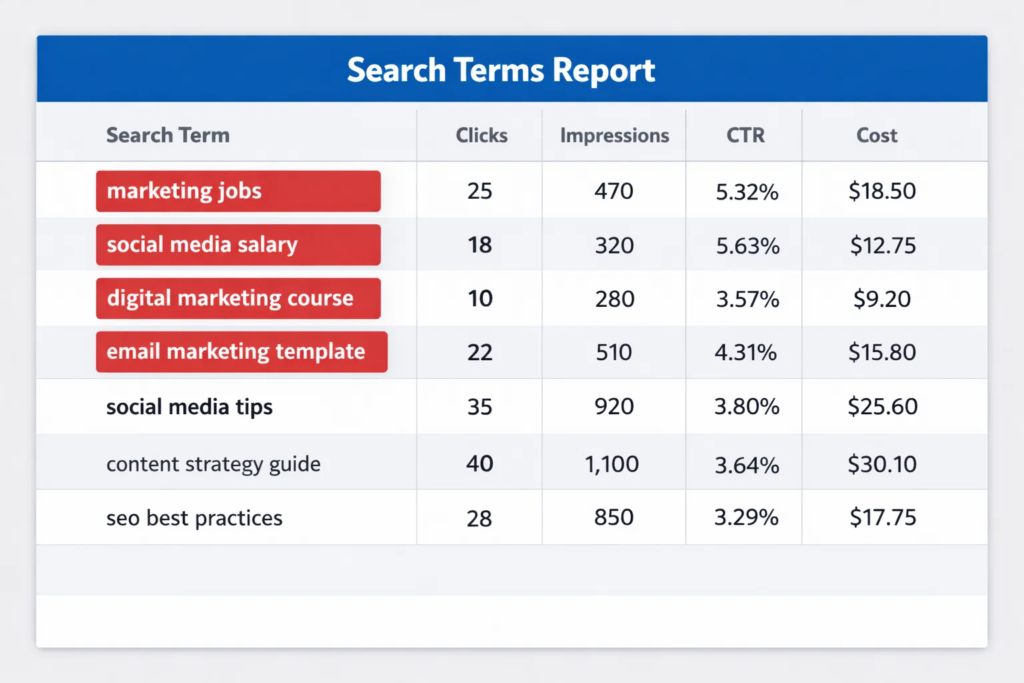

Are your keywords or audiences bringing “wrong job” traffic?

This is common in B2B SaaS when your keywords overlap with hiring, education, or certifications.

Examples:

- “Analytics platform” can pull students

- “CRM workflow” can pull job seekers

- “Project management software” can pull people looking for templates

- “RPO” or “recruitment” terms can pull candidates instead of employers

If you see a lot of short sessions, high bounce, and form fills with personal emails, you may be paying for the wrong persona.

What to look at:

- Search terms report for job intent words

- Audience segments that skew young or student-heavy

- Page paths that start with “careers,” “blog,” or “templates”

- Form entries that do not match your ICP fields

Use negatives and exclusions early. Do not wait until the spending is painful.

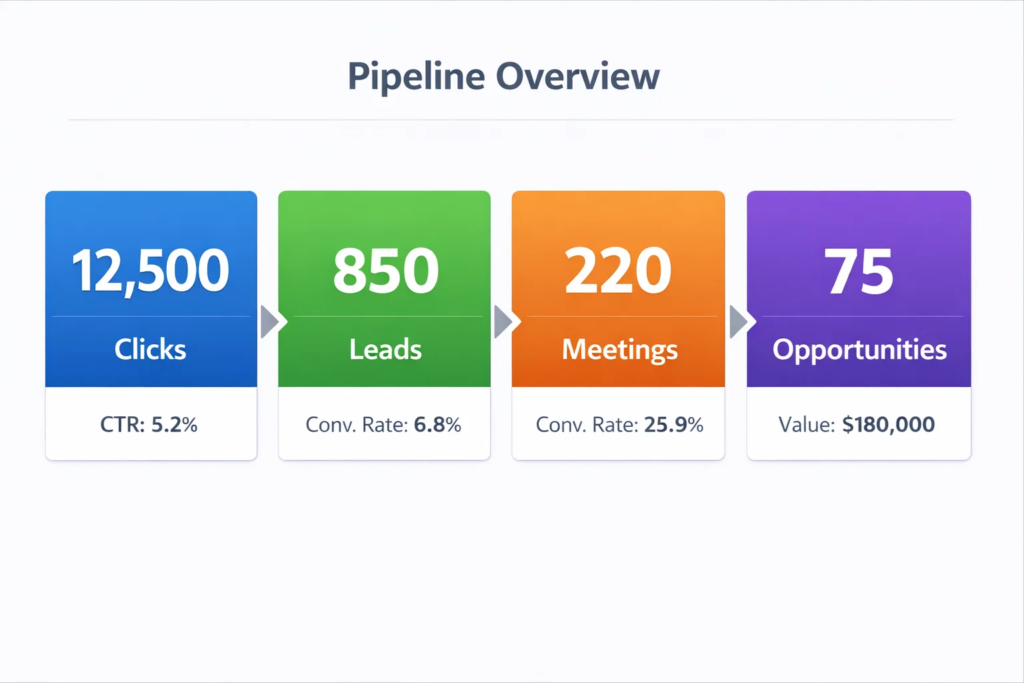

Do you know which clicks become sales conversations?

Most teams can tell you CPC and CTR.

Far fewer can tell you “click to opportunity” by campaign.

This is where B2B SaaS teams lose confidence in paid acquisition. Not because ads do not work, but because visibility is weak.

If your CRM does not capture source cleanly, or your lead statuses are not updated, your best campaigns can look average, and your worst campaigns can hide.

At a minimum, you want to answer these questions:

- Which campaigns create qualified meetings?

- Which campaigns create opportunities?

- Which campaigns create revenue?

- How long does each step take?

If you cannot answer those, you are guessing with the budget.

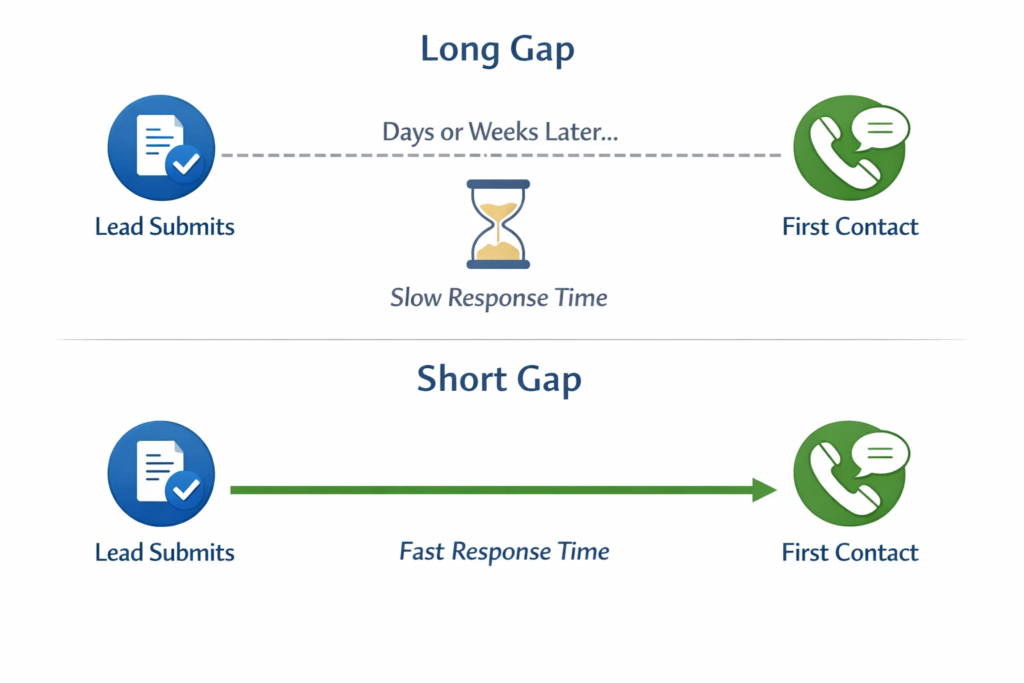

Are leads dying after the form because of speed, routing, or follow up?

Sometimes the click is good.

The system after the click is not.

In B2B SaaS, small operational gaps can destroy the close rate:

- Leads are not assigned quickly

- SDRs do not trust inbound sources

- Meeting links are buried

- The first email is generic

- The first call happens 2 days later

A practical benchmark: if a lead requests a demo and your first human response is hours later, you will lose deals you never even knew you had.

One real-world example (when this shows up):

A company sees “low-quality demo requests.”

When they check timestamps, 60 percent of leads are contacted the next day.

After fixing routing and adding a 5-minute SLA, the show rate jumps without changing ads.

Are you measuring the wrong channel because attribution is misleading?

Attribution in B2B SaaS is messy.

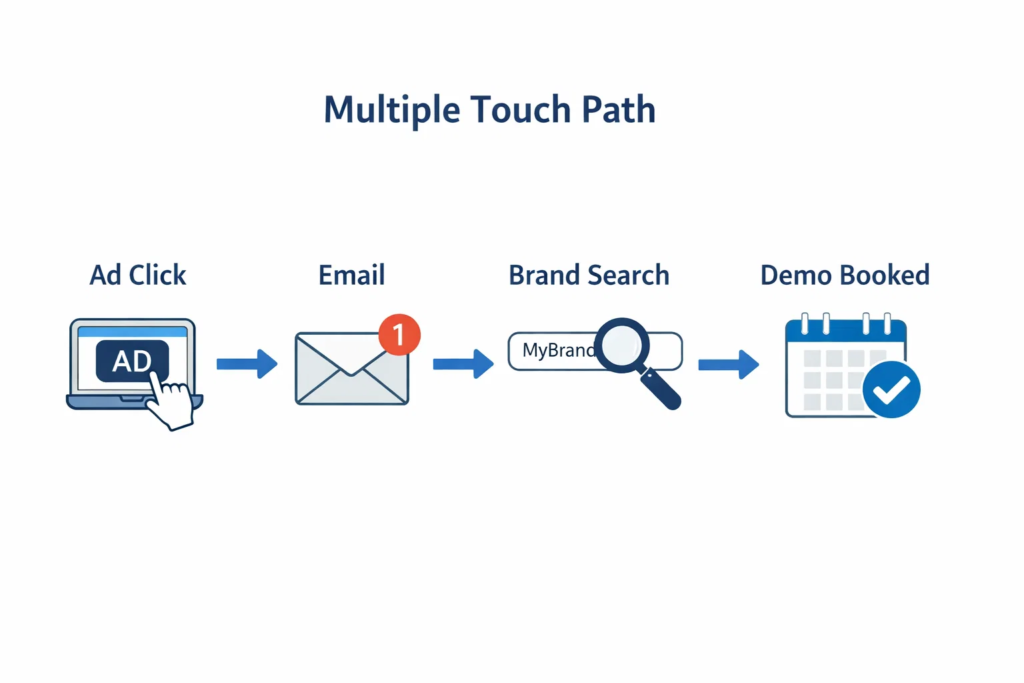

Someone clicks an ad, reads your page, leaves, asks a colleague, Googles your brand later, then books a demo.

If you only look at last click, you will undervalue upper funnel channels and sometimes even undervalue non brand search.

Common patterns that create false conclusions:

- LinkedIn looks unprofitable on the last click, but influences branded search

- You optimize only on “thank you page views” and inflate conversion volume

- Your tracking breaks on iOS privacy changes, and you blame the ads

- Offline revenue never gets sent back to the ad platform

The fix is not “use a better dashboard.”

The fix is connecting ad touches to CRM stages, even if the match rate is imperfect.

How can you tell fast if you’re paying for clicks you’ll never close?

Here’s a simple diagnostic you can run without fancy tooling.

Look at one week of data and answer these:

- Which campaigns produced leads that your team actually contacted?

- Of those, which produced meetings?

- Of those, which produced opportunities?

Then compare against the spend.

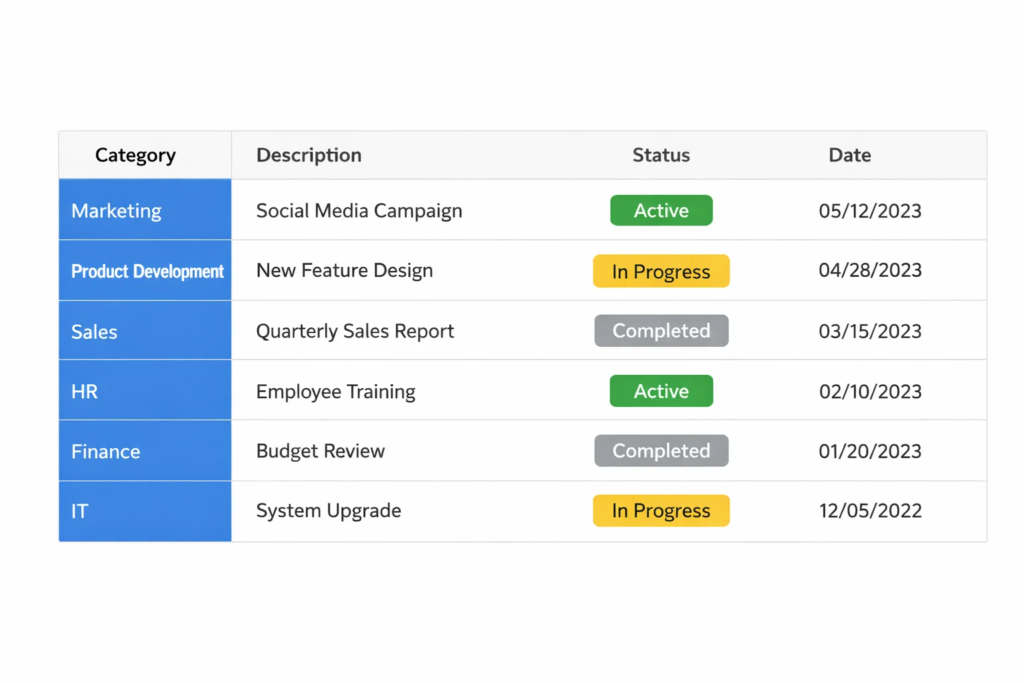

Use this table to interpret what you see:

| What You See | What It Usually Means | What To Do Next |

|---|---|---|

| High clicks, high bounce, low time on page | Message match or wrong intent | Tighten ad promise, improve above the fold, add negatives |

| Leads are coming in, but few have been contacted | Routing or SLA issue | Fix assignment, set response time target, automate alerts |

| Meetings booked, low show rate | Weak qualification or calendar friction | Add fit fields, confirm email, simplify scheduling |

| Good meetings, no opportunities | ICP mismatch or value narrative gap | Add disqualifiers, rewrite offer, adjust targeting |

| Leads are coming in, but few contacted | Sales cycle friction | Opportunities exist, but no revenue |

This is the difference between “ads are expensive” and “the system is leaking.”

Which campaign types hide bad clicks the most?

Not all clicks behave the same.

Some campaign types can mask low intent because they generate volume easily.

A few watchouts:

- Broad match search without tight negatives

- Performance-based campaigns that expand beyond your intent signals

- Retargeting that looks great, but mostly captures people who would convert anyway

- Display placements that inflate traffic quality issues

This does not mean these campaign types are bad.

It means they need stricter guardrails in B2B SaaS, like better conversion signals, exclusions, and clear landing pages.

What should you change this week to stop paying for dead clicks?

You do not need a full rebuild to improve click quality.

Try these moves in order:

First, clean intent.

Review search terms. Add negatives. Cut the obvious noise.

Second, upgrade the conversion signal.

Stop optimizing for events that do not map to the pipeline.

Third, tighten the page.

Make the first scroll about who it is for, what it solves, and why you are credible.

Fourth, fix response speed.

If sales are slow, your cost per opportunity will look worse than it should.

Fifth, create one “buyer proof” asset.

A short case study section, a comparison page, or a pricing explainer can turn high-intent clicks into meetings.

Keep changes focused. Run them for a week. Measure click to meeting, not just click to lead.

When is it actually okay to pay for clicks that won’t close yet?

Not every click has to close this month.

In B2B SaaS, some clicks build demand. They create familiarity and future branded search.

The key is knowing when you are buying awareness on purpose, versus buying low intent by accident.

If you are running upper funnel campaigns, set expectations clearly:

- Different landing page

- Different call to action

- Different success metric

- Clear retargeting path

If you mix upper funnel clicks with bottom funnel expectations, you will always feel like paid is “not working.”

A simple closing thought

If you feel like you’re paying for clicks you’ll never close, you’re probably not wrong.

Most of the time, the issue is one of these:

- You are attracting the wrong intent

- You are measuring the wrong thing

- You are losing good leads after the click

Fixing it is not magic.

It is a set of small, visible decisions that connect spend to pipeline in a way your team can trust.