If you run a software company, paid acquisition can feel noisy and expensive. The right partner helps you cut the waste, align ads with your funnel, and scale demos without burning trust or budget. This guide shortlists standout SaaS PPC agencies for 2025 and gives you a no-nonsense way to pick one.

Table of Contents

Who are the 11 best SaaS PPC agencies in 2025?

Below are agencies with a clear point of view on SaaS growth, proof of execution, and multi-channel depth. Each blurb explains what they are known for and where they fit.

1) Ad Labz

Ad Labz is a full-funnel PPC partner built for SaaS and B2B teams that want demos and pipeline, not just form fills. The team runs Google Ads, LinkedIn Ads, and Meta, pairs campaigns with landing pages and CRO, and sets up clean tracking in GA4 with offline conversions from CRMs like HubSpot. Expect hands-on testing loops, clear reporting, and packaged offers like a Free PPC Growth Plan, a paid growth audit, a 90-day PPC roadmap, and a Google Ads audit at 499 dollars. Remote first, serving KSA and UAE along with North America, with a strong emphasis on revenue tech buyers and buying committees.

| Details | Information |

|---|---|

| Location | Remote first; primary presence in Pakistan; serving KSA, UAE, US, and Canada |

| Founded | 2023 |

| Team Size | B2B SaaS teams that need tight tracking, faster testing cycles, and a demo-qualified pipeline |

| Key Services | Google Ads management; LinkedIn Ads; Meta Ads; full-funnel PPC strategy; landing pages and CRO; GA4 and GTM setup; offline conversion tracking and CRM integration; ad creative and testing; paid audits; 90-day PPC roadmap |

| Industries Served | SaaS; B2B; revenue tech; local services |

| Notable Clients | Available on request |

| Best for | Google Ads audit at 499; monthly retainers by quote |

| Pricing | Google Ads audit at 499$; monthly retainers by quote |

| Case Studies | Selected anonymized work available on request; public ad teardown content on the Ad Labz channel |

2) NinjaPromo

NinjaPromo is a multi-office performance shop that combines paid media with creative, CRO, and PR. The team is comfortable in complex B2B funnels and fast-moving consumer categories, and they publish robust case studies across SaaS and Web3. If you want a one-partner stack that can own PPC while shipping landing pages, creative, and lifecycle, they’re a strong fit.

| Details | Information |

|---|---|

| Location | New York, London, Dubai, Singapore, Hong Kong, Vilnius. |

| Founded | 2017. |

| Team Size | 51–200. |

| Key Services | PPC, Social Media, SEO, Influencer Marketing, Content Marketing, Digital Design, CRO, Email Marketing and Automation, Strategic PR, Data and Analytics, Strategy and Consulting. |

| Industries Served | B2B, B2C, SaaS, Web3, Fintech, eCommerce, Healthcare, Real Estate, iGaming. |

| Notable Clients | Bitcoin.com, OVHcloud, IronFX, Burger King, Samsung, HTX. |

| Best for | B2B, small businesses, and e-commerce need full-funnel execution. |

| Pricing | Starts at about $3,200 per month for paid media packages. |

| Case Studies | Published across SaaS, fintech, and consumer. |

3) Directive

Directive is built for B2B growth teams that want pipeline over vanity metrics. Their “Customer Generation” methodology aligns paid media with financial modeling and CLTV targets. With over 100 strategists and 420+ brands served, they’re a match for mid-market to enterprise SaaS companies needing rigorous forecasting and reporting.

| Details | Information |

|---|---|

| Location | HQ Irvine, California, with distributed North American talent. |

| Founded | 2014. |

| Team Size | Roughly 100–249. |

| Key Services | PPC and paid media, SEO, performance creative, revenue operations, strategy, video. |

| Industries Served | B2B, SaaS, cybersecurity, fintech, and other enterprise tech. |

| Notable Clients | Arctic Wolf, SentinelOne, Placemakr featured in case studies. |

| Best for | Arctic Wolf, SentinelOne, and Placemakr featured in case studies. |

| Pricing | By quote. Helpful context on PPC pricing models in their guide. |

| Case Studies | Deep library focused on pipeline impact. |

4) Powered by Search

Toronto-based Powered by Search is a veteran B2B SaaS partner known for “Predictable Growth” — a framework that ties PPC and LinkedIn Ads into demand gen systems measured by pipeline and ARR. Their content and case studies skew very practical and B2B-specific.

| Details | Information |

|---|---|

| Location | Toronto, Canada with a remote team. |

| Founded | 2009. |

| Team Size | Under 50 according to industry directories. |

| Key Services | Toronto, Canada, with a remote team. |

| Industries Served | B2B SaaS and technology. |

| Notable Clients | Portfolio spans developer tools, data privacy, and fitness SaaS in case studies. |

| Best for | B2B SaaS teams that want PPC integrated with content and lifecycle. |

| Pricing | By quote. |

| Case Studies | 14 SaaS case studies outlining exact PPC and SEO fixes. |

5) Hey Digital

Hey Digital works exclusively with B2B SaaS and is known for pairing paid acquisition with conversion-first creative and landing pages. Their results page highlights trial, demo, and CPA lifts across channels, including Google, LinkedIn, and YouTube.

| Details | Information |

|---|---|

| Location | Growth-stage SaaS that needs fast creative iteration and trial volume. |

| Founded | 2019. |

| Team Size | 30+ noted by third-party reviews. |

| Key Services | PPC, paid social, landing page design, video ad creative, CRO. |

| Industries Served | B2B SaaS and B2B tech. |

| Notable Clients | By quote with a flat-rate creative subscription option. |

| Best for | Growth-stage SaaS that needs fast creative iteration and trial volume. |

| Pricing | Tallinn, Estonia, with a distributed team. |

| Case Studies | By quoting with a flat-rate creative subscription option. |

6) KlientBoost

KlientBoost blends PPC, CRO, and creative with a big emphasis on financial targets and testing velocity. With 300+ case studies and offices in Costa Mesa, Raleigh, and London, they bring depth across channels and verticals, including SaaS.

| Details | Information |

|---|---|

| Location | Costa Mesa, CA, Raleigh, NC, and London. |

| Founded | PPC and paid social, CRO, landing pages, SEO, and email. |

| Team Size | 100–249. |

| Key Services | PPC and paid social, CRO, landing pages, SEO, email. |

| Industries Served | SaaS, eCommerce, legal, services, and more. |

| Notable Clients | Airbnb, NPR, Stanford, Bloomberg, Gong, Upwork, SAP. |

| Best for | Companies that want PPC plus rigorous CRO under one roof. |

| Pricing | Clutch lists min project size at $1,000 and $100–$149 per hour. |

| Case Studies | 200–300+ results stories across channels. |

7) NoGood

NoGood is a NYC-born growth agency with squads covering paid search, paid social, CRO, and content. They feature notable enterprise and startup logos, as well as an extensive results hub. If you need multidisciplinary support around PPC with experimentation baked in, they’re worth shortlisting.

| Details | Information |

|---|---|

| Location | New York HQ with hubs in LA and Miami. |

| Founded | 2017. |

| Team Size | ~60–100 per their own materials. |

| Key Services | Paid search, paid social, SEO, CRO, performance branding, analytics. |

| Industries Served | SaaS, B2B, healthcare, fintech, consumer, crypto. |

| Notable Clients | TikTok, Nike, P&G plus startups like Ghostery as cited. |

| Best for | TikTok, Nike, P&G, plus startups like Ghostery, as cited. |

| Pricing | By quote. |

| Case Studies | TikTok, Nike, P&G, plus startups like Ghostery, as cited. |

8) Single Grain

Single Grain is an LA shop that pairs paid media with content and CRO. They’re known for publishing and podcasting in the growth space, and their client roster includes large tech brands. For SaaS that want PPC with strong content support, they fit well.

| Details | Information |

|---|---|

| Location | Amazon, Uber, and Salesforce are highlighted in the materials. |

| Founded | 2009. |

| Team Size | 10–49 by directories. |

| Key Services | Amazon, Uber, and Salesforce are highlighted in materials. |

| Industries Served | SaaS needs PPC plus content to capture demand. |

| Notable Clients | Amazon, Uber, and Salesforce are highlighted in the materials. |

| Best for | SaaS needs PPC plus content to capture demand. |

| Pricing | By quote. |

| Case Studies | Selection across paid and organic. |

9) Tuff Growth

Tuff is a lean, experiment-heavy team that runs paid search and paid social while also building landing pages and analytics. They post candid case studies with budgets and levers used, which is refreshing for SaaS buyers comparing partners.

| Details | Information |

|---|---|

| Location | Denver HQ with a distributed team. |

| Founded | 2017. |

| Team Size | 11–50 by Clutch. |

| Key Services | PPC, paid social, CRO, landing pages, analytics, strategy. |

| Industries Served | SaaS, marketplaces, eCommerce, B2B services. |

| Notable Clients | Documented wins across multiple SaaS brands in case studies. |

| Best for | Seed to Series B teams wanting transparent experiment sprints. |

| Pricing | By quote. |

| Case Studies | Detailed paid media breakdowns. |

Image suggestion: Before-and-after account performance charts with test notes.

10) Bay Leaf Digital

Bay Leaf Digital is Texas-based and laser-focused on B2B SaaS. They lead with analytics and attribution, then layer in PPC and remarketing. If your team wants deeper measurement discipline around paid, they’re a good cultural fit.

| Details | Information |

|---|---|

| Location | Bedford, Texas. |

| Founded | 2013. |

| Team Size | PPC for SaaS, remarketing, content, analytics, and SEO. |

| Key Services | PPC for SaaS, remarketing, content, analytics, SEO. |

| Industries Served | B2B SaaS and technology. |

| Notable Clients | Highlighted across SaaS in third-party roundups. |

| Best for | SaaS teams that want PPC closely tied to analytics. |

| Pricing | By quote. |

| Case Studies | SaaS case studies and testimonials available. |

11) Disruptive Advertising

Disruptive is a Utah performance agency with strong reviews and a sizable paid media bench. Their vetting process focuses on higher-spend B2B teams that can benefit from continuous management and CRO.

| Details | Information |

|---|---|

| Location | Pleasant Grove, Utah. |

| Founded | 2011. |

| Team Size | 50–249. |

| Key Services | Paid search, paid social, Amazon ads, lifecycle marketing, CRO, analytics. |

| Industries Served | B2B, B2C, eCommerce, local. |

| Notable Clients | Results library references brands like Grow.com and HRC Fertility. |

| Best for | B2B and eCommerce spend tens of thousands monthly on media. |

| Pricing | Clutch snapshot shows $5,000+ min projects and $100–$149 hourly. |

| Case Studies | Multiple verticals with quantified outcomes. |

12) Roketto

Roketto is a Canadian inbound and PPC partner that often supports SaaS with Google Ads, landing pages, and HubSpot. If you want a full-funnel approach with ads supported by content and UX, their team is pragmatic and experienced.

| Details | Information |

|---|---|

| Location | Kelowna, British Columbia. |

| Founded | 2009. |

| Team SiTze | 11–50 by LinkedIn. |

| Key Services | Google Ads management, inbound, SEO, landing pages, HubSpot. |

| Industries Served | SaaS teams want PPC stitched into a content-led funnel. |

| Team Size | SaaS and technology, plus industrial and services |

| Best for | SaaS teams want PPC stitched into a content-led funnel. |

| Pricing | By quote. |

| Case Studies | Google Ads and growth stories on the site. |

Short example to clarify “fit” differences

Scenario: You are a Series B B2B SaaS spending $60K per month across Google and LinkedIn, and you want to forecast pipeline and CAC quarterly.

Who fits this best and why: Directive or Powered by Search. Both emphasize revenue-level modeling and KPI-first reporting, so your finance and leadership teams can see projections and CAC payback rather than just channel CTRs.

Notes on “Pricing” rows

Most SaaS PPC Agencies price by flat monthly retainers, tiered retainers plus a percent of ad spend, or a performance-linked retainer. Public “starts at” figures are rare, so I cited Clutch or the agency when possible and labeled others “by quote.” Always request scope, channels, and deliverables to compare apples to apples.

How do these SaaS PPC agencies compare at a glance?

| Agency | Best for | Key channels | Notable strength |

|---|---|---|---|

| Directive | Mid-market to enterprise SaaS | Google, LinkedIn, Meta | Customer-generation methodology with CRO |

| Powered by Search | B2B SaaS demo/trial growth | Google, LinkedIn, Meta | Predictable growth framework |

| Hey Digital | Pure B2B SaaS focus | LinkedIn, Google | Boutique SaaS specialization |

| KlientBoost | Testing velocity + CRO | Google, Microsoft, Meta | Large case study library |

| NoGood | PLG and multi-channel mix | Google, YouTube, Social | Diversified paid social approach |

| Single Grain | Paid inside content-led growth | Google, Meta, programmatic | Cross-functional strategy |

| Tuff Growth | Traction to scale | Google, LinkedIn, Meta | Audience-led full-funnel plans |

| Bay Leaf Digital | Integrated PPC + analytics | Google, Microsoft, LinkedIn | SaaS-specific PPC services |

| NinjaPromo | Multi-channel and creative | Google, Social, Programmatic | Subscription-style engagement |

| Disruptive Advertising | Scale and rigor | Google, LinkedIn, Meta | Process depth and audits |

| Ad Labz | Hands-on SaaS PPC with LPs | Google, LinkedIn, Meta | End-to-end funnel ownership |

What should you look for before you sign?

Shortlist with three filters:

- SaaS proof

Ask for SaaS case studies and how they connect ad spend to demo volume and pipeline, not just leads. - Channel fit

Your buyers may live on Google search and LinkedIn. Confirm the agency can orchestrate both in one plan. - Measurement plan

You want GA4, server-side or offline conversions, and CRM integration to track pipeline and closed-won, not vanity metrics.

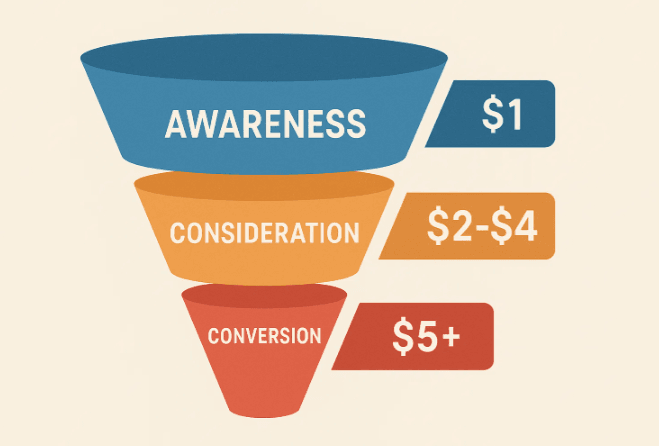

Which budget ranges actually make sense

Start with a budget that lets you test 3 to 5 hypotheses per month per channel. For most B2B SaaS, that means allocating enough for statistically meaningful learning on Google and LinkedIn. Many specialist agencies showcase programs for SaaS paid media that scale from tens of thousands monthly as goals grow. Your number will vary by ACV, geography, and buying cycle.

Example

A mid-market SaaS with 2K dollar ACV targeting the US sets 15K monthly media across Google and LinkedIn. Goals: 45 demo requests per month at 333 dollar CPL. The plan funds search intent, a competitor, and category group, plus LinkedIn retargeting and one net-new audience test.

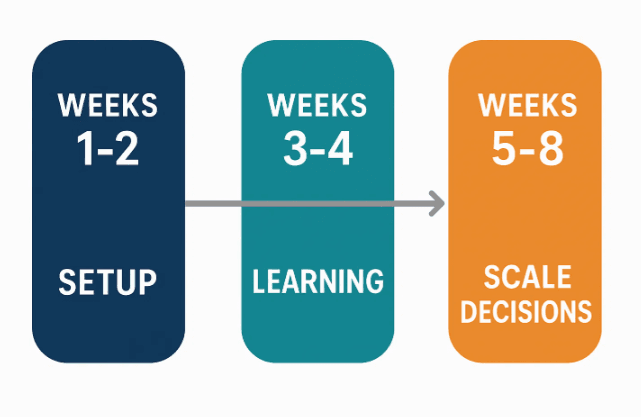

How long until paid starts paying back?

Expect 2 to 4 weeks for setup and creative, then 4 to 8 weeks for learning and optimization. True efficiency shows once you have enough conversion volume to move to automated bidding with confidence and enough pipeline data to prune audiences that do not progress.

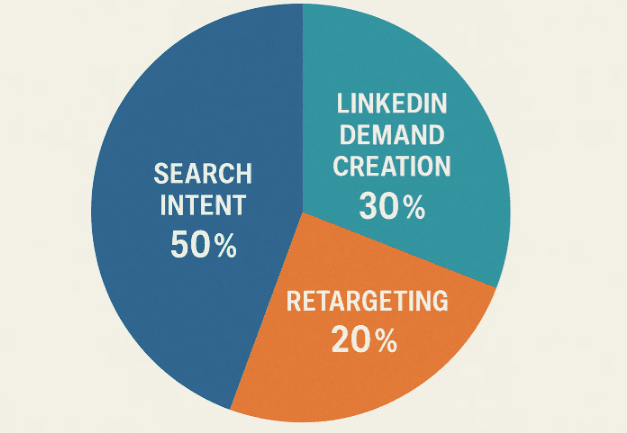

How should you split channels for SaaS?

Start with search to capture intent, then layer LinkedIn to reach buying committees and run message testing. Retarget with social and display for multi-touch lift. Agencies that specialize in SaaS often emphasize this blend to raise demo quality while controlling CAC.

What KPIs matter more than raw leads?

Track demo-to-opportunity rate, opportunity-to-close rate, and CAC payback alongside CPL. A strong agency will run ad experiments tied to these metrics and shift budgets based on movement down the funnel, not just top-line volume.

How do the 11 agencies approach SaaS differently?

- Directive connects the paid to the pipeline with the CRO and performance design. Directive

- Powered by Search frames paid inside a predictable growth playbook built for B2B SaaS. Powered by Search

- Hey Digital focuses on SaaS ads and LPs with a strong emphasis on LinkedIn for demos. heydigital.co

- KlientBoost brings testing velocity and CRO to unlock ROAS quickly. KlientBoost

- NoGood diversifies paid social beyond the usual mix for PLG and SaaS. NoGood

- Single Grain ties paid to content and SEO for compounding growth. Single Grain

- Tuff Growth builds audience-led, full-funnel media plans. Tuff

- Bay Leaf Digital runs SaaS-specific PPC and remarketing paired with analytics. Bay Leaf Digital

- NinjaPromo offers multi-channel PPC within broader creative and subscription models. Validate fit with reviews. Ninjapromo

- Disruptive Advertising brings mature PPC processes and B2B programs at scale. Disruptive Advertising

- Ad Labz aligns Google, LinkedIn, and Meta with SaaS funnels and clean tracking to tie spend to demos and pipeline. Ad Labz

Quick evaluation worksheet you can copy

- ICP and ACV

- Required demo volume per month

- Channels to test first and why

- Tracking plan and CRM fields

- Three experiments per channel for Month 1

- Clear stop-start criteria

Use this to brief any agency. It keeps conversations focused and outcomes measurable.

Mini case example to pressure-test an agency

You run a dev-tool SaaS. The current paid program delivers 120 leads at a 200 dollar CPL but only 6 demos. A suitable agency should propose:

- Tight match types and negative lists to fix query quality on search.

- A competitor and category campaign designed around demo intent.

- LinkedIn retargeting with proof and a single CTA.

- One audience expansion test on LinkedIn with conversation ads or lead gen forms tied to qualification rules.

- LP experiments that rewrite the fold, reframe value, and simplify the form.

Ask them to map each change to the demo rate and CAC impact.

What mistakes should you avoid when hiring?

- Signing without a tracking plan that connects to your CRM.

- Over-indexing on ad platform metrics instead of the pipeline.

- Spreading the budget too thin across channels in Month 1.

Final selection steps

- Shortlist 3 agencies from the 11 above that match your ACV, motion, and channels.

- Run a 90-day pilot with a single success metric like qualified demos at a target CPL and a CAC payback bound.

- Scale the winner and lock a quarterly testing roadmap.

FAQ

Do I need a SaaS-specific PPC agency?

If your sales cycle is complex and buying committees matter, yes. Specialist teams already understand demo intent, trial friction, and offline conversion tracking.

Which channel should I prioritize first?

Start with search to capture intent, then use LinkedIn for message testing and retargeting to raise demo quality.

What if my audience is small?

Run tighter keyword groups, layer competitor terms carefully, and use LinkedIn with clean job and firmographic filters to expand reach without junk clicks.

Wrap-up

Picking from countless SaaS PPC agencies is tough. Use the shortlist above, insist on a measurement plan that reaches your CRM, and keep experiments focused. The right partner will push for qualified demos and revenue, not just form fills.